|

Return To Main Page

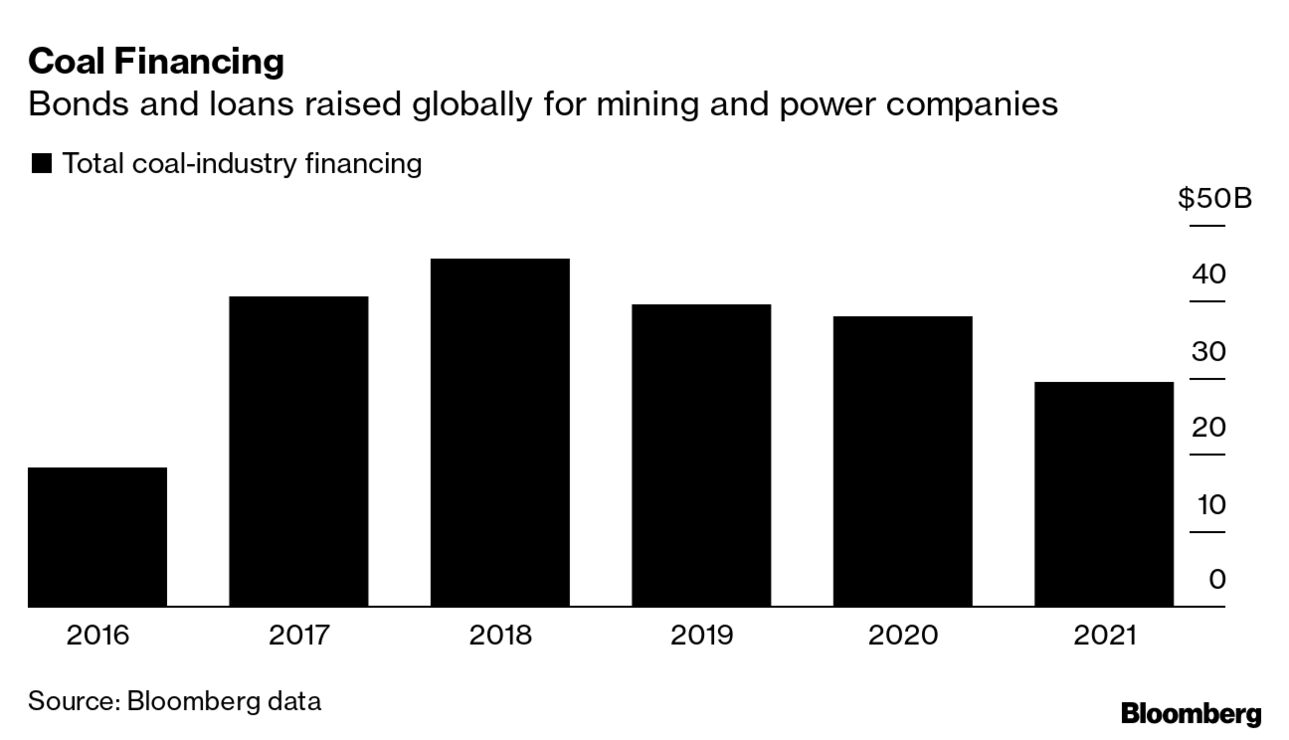

Granted it’s still early in 2022, but signs are emerging that the amount of financing going to coal-related projects is running at a rate that’s more than double last year’s pace. With the first quarter coming to a close, banks (mostly based in China) have helped coal companies raise $9.9 billion via loans and bond sales, according to data compiled by Bloomberg. For comparison, the number was closer to $4.4 billion during the first three months of 2021. While the biggest chunk of the coal money is being accumulated for Chinese coal endeavors, the increase nevertheless runs counter to all the global banking sector chatter about its supposed commitment to helping the world cut dangerous emissions. And there’s no more dangerous fossil fuel than coal—the single largest source of global temperature rise. “It’s amazing that the numbers are so big,” said Alison Kirsch, research and policy manager at Rainforest Action Network, which published its 13th annual “Banking on Climate Chaos” report Wednesday. “Why, in 2022, are banks still financing coal?” Bankers put coal in “the penalty box” in 2015 when they started drawing a line around mining of the combustible, black-sedimentary rock, Kirsch said. Since then, it looks like coal got back out on the ice. The data show coal financing close to doubled in 2017 and has remained elevated ever since.

Coal power needs to be phased out by nations in the Organization for Economic Cooperation and Development and the European Union by 2030—and by 2040 in the rest of the world—to meet the goals of the Paris Agreement, Kirsch said, citing reports from the United Nations and Climate Analytics. Increasing coal investment makes this more difficult. Some banks seem to be trying. HSBC Holdings Plc promised earlier this month to “phase down” its exposure to fossil fuels, sending a warning to oil and gas clients. The bank said it will look at updating its wider financing polices, including those for conventional and unconventional oil and gas, methane emissions and environmentally critical areas such as the Arctic and Amazon. As for coal, HSBC said in December that it plans to stop financing the industry by 2040. And despite HSBC’s large China presence, the bank has done little in recent years to help coal miners raise money through the debt markets, Bloomberg data show. Instead, the leaders in this area have been lenders such as China Securities, an affiliate of Citic Securities, and Industrial Bank Co., a mid-sized Chinese bank based in Fuzhou. The main conclusion from the Rainforest Action publication is that runaway funding for fossil-fuel extraction and infrastructure is “causing climate chaos and threatening the lives and livelihoods of millions.” Citing Bloomberg data among its sources, Rainforest Action reported that the world’s 60 largest banks helped provide about $4.6 trillion to oil, gas and coal companies since the Paris climate agreement was announced at the end of 2015. And notably, the inability of bankers to cut off the spigot to coal is “just horrible,” Kirsch said.

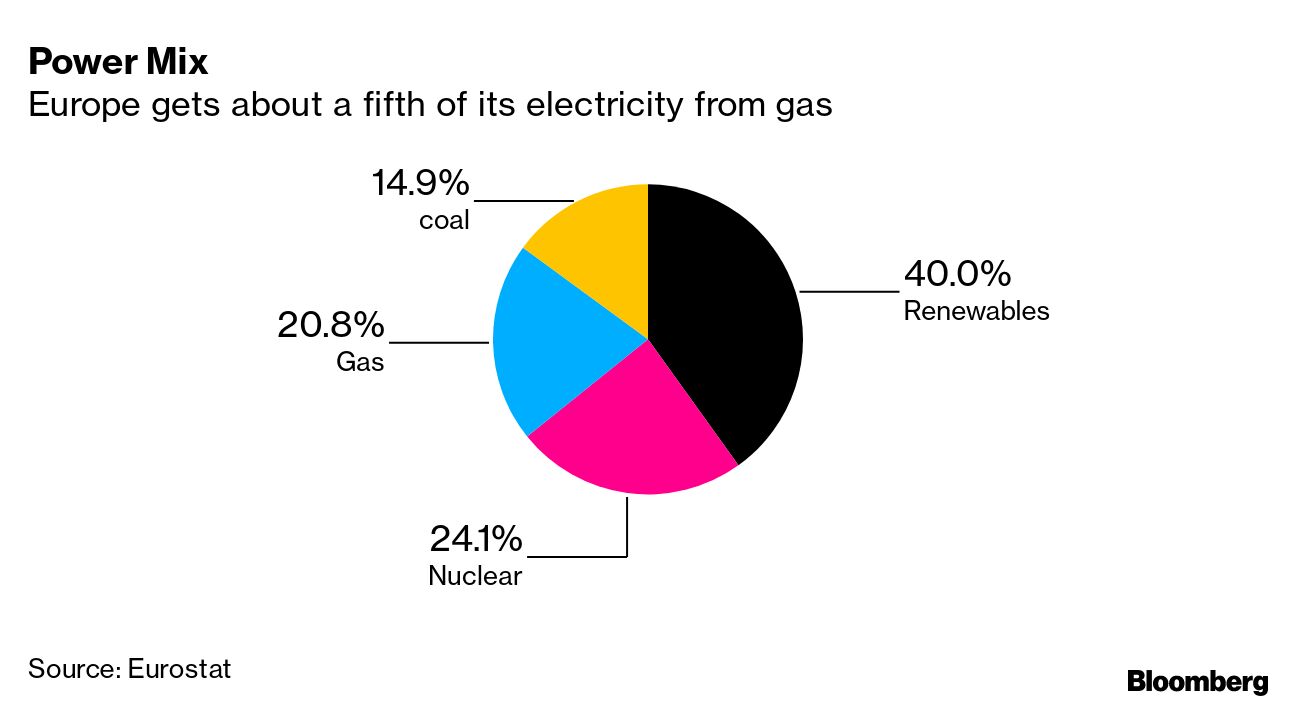

The conversation around coal has been growing since Vladimir Putin launched his war on Ukraine. Europe relies on natural gas from Russia, and the war has prompted nations, including Germany, to consider keeping open their coal plants. “The big picture here is this is a moment to rapidly uptick the movement toward renewables, and instead, the opposite is happening,” Kirsch said. “We aren’t accelerating the transition.” Rainforest Action, which along with other climate-focused nonprofits including BankTrack, Reclaim Finance and Sierra Club, has developed scores for banks. Not too surprisingly, those that rank among the lowest have been lenders that extend the most funding to fossil fuels, namely JPMorgan Chase & Co. and Citigroup Inc. Wells Fargo & Co. has rated among the world’s top fracking banker and Barclays Plc has placed at the bottom of the pack in Europe. As for coal, Industrial Bank has been among the biggest bankers of mining. “It’s pretty stark,” Kirsch said. “It’s past the time for every bank in every country to immediately end their support for the expansion of coal mining and power.”

Here’s what else you need to know in Green

Green Play Ammonia™, Yielder® NFuel Energy.

|