|

March 29, 2023

By

Andrew Hecht

Why Are U.S.

Natural Gas Futures So Low?

Natural gas

futures are as volatile as the raw commodity when extracted from the

earth’s crust. Since 1990, NYMEX natural gas futures for delivery at

the Henry Hub pipeline in Erath, Louisiana, have experienced periodic

explosive and implosive price moves.

The U.S. natural

gas futures arena

had been in a bearish trend of lower highs and lower lows from 2005,

when the price reached a record $15.78 high, through June 2020, when

it traded to a quarter-of-a-century $1.44 low. It took a little over

two years for the price to explode to the highest price since 2008 but

six months to fall below $2.

On February 7,

2023, I highlighted that natural gas had no inventory or supply

concerns on Barchart,

with the price of nearby NYMEX futures sitting around the $2.50 per

MMBtu level. In that article, I pointed out natural gas stocks were

sitting 9.4% above the previous year and 6.7% above the five-year

average as of February 2.

In late March

2023, the inventory situation worsened for anyone bullish on the

energy commodity. However, natural gas is at a price that may not have

too much more downside.

Inventories at a high level compared to the past years

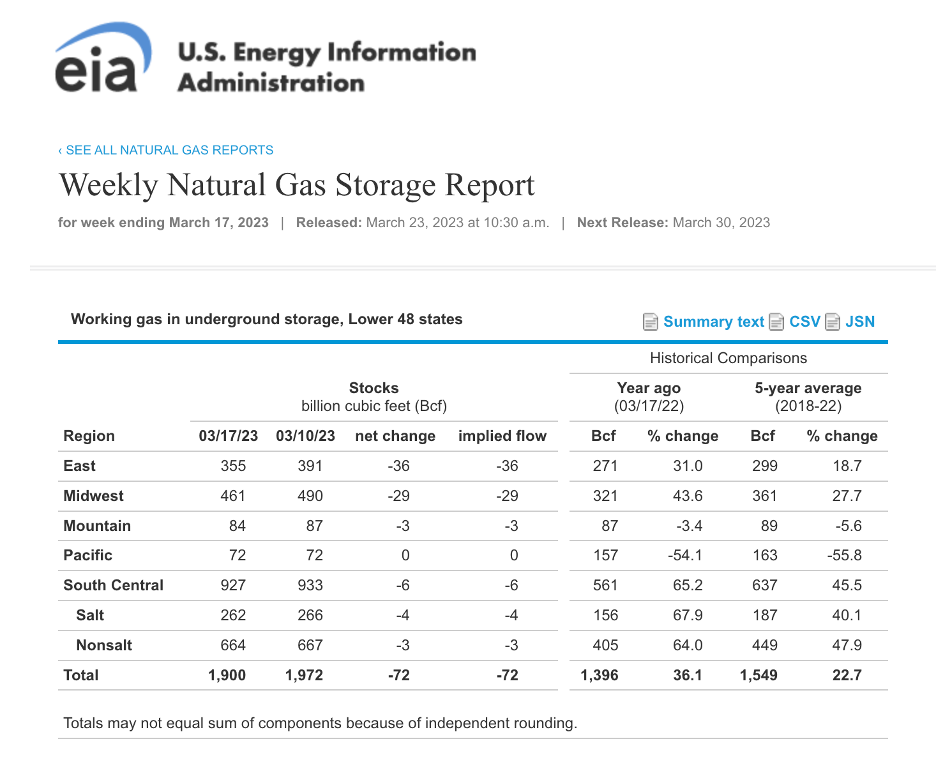

The latest Energy

Information Administration natural gas stockpile data shows that

natural gas inventories have exploded to the highest level in years.

Source: EIA

The chart highlights that natural gas in storage across the U.S. stood

at 1.9 trillion cubic feet for the week ending on March 17, 2023. The

stocks were 36.1% higher than in mid-March 2022 and 22.7% over the

five-year average.

The 2023 injection season begins soon

Typically, the withdrawal season in natural gas ends, and the

injection season starts in late March annually. Over the past years,

natural gas stockpiles were at the following levels at the end of the

peak withdrawal season:

2022- 1.382 trillion cubic feet

2021- 1.750 trillion cubic feet

2020- 1.986 trillion cubic feet

2019- 1.107 trillion cubic feet

At the 1.900 tcf level on March 17, natural gas stocks were

below the 2020 level but will likely end the 2023 withdrawal season

above the levels in 2021, 2022, and 2019.

As of the week ending on March 24, 2023, Baker Hughes reported

that 162 natural gas rigs were operating in the United States, 25 rigs

above the level at the same time in 2022. The bottom line is plenty of

natural gas is in storage to meet requirements, and production running

at a higher level than last year, with 25 more rigs extracting natural

gas from the earth’s crust in March 2023 than in March 2022, which

remains bearish.

Natural gas is inexpensive, which does not mean it will not get

cheaper

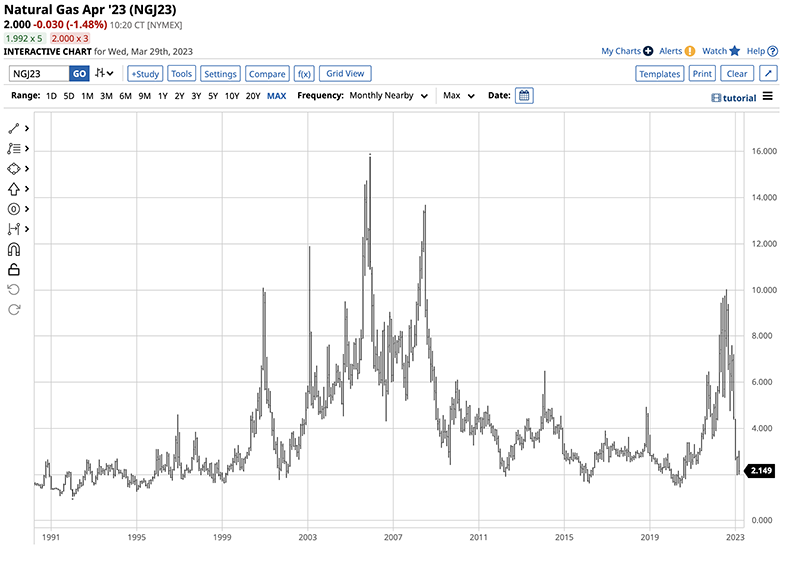

The chart shows

the steady plunge from the August 2022 $10.028 high to the $1.967 per

MMBtu low in February 2023. At the $2 level on the continuous futures

contract on March 29, natural gas remains near the recent low, and the

trend remains bearish. The trend is always your best friend, and while

it remains bearish, natural gas for delivery at the Henry Hub pipeline

in Erath, Louisiana is at $2 per MMBtu, meaning after a nearly $8 drop

over the past seven months, a continuation could threaten the

twenty-five year low, the all-time bottom since 1990, and even zero, a

level we saw breached in the nearby NYMEX

crude oil futures in

April 2020.

Natural gas may be

cheap at $2 per MMBtu on the nearby April contract on March 29, but a

continuation of the price decline is not out of the question.

Europe and the U.S. dodged a bullet over the past months- Futures do

not reflect consumer prices

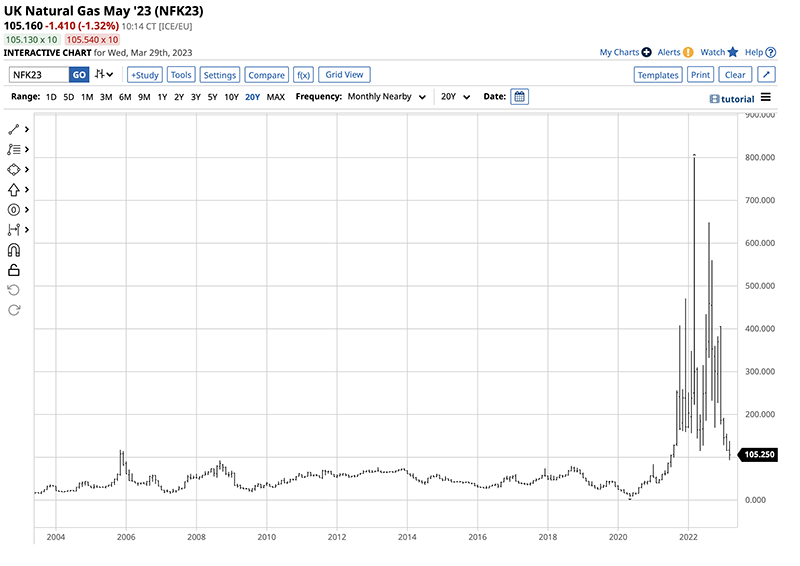

U.S. NYMEX natural

gas rallied to a fourteen-year high at over $10 per MMBtu in August

2022 as the war in Ukraine pushed U.K. and Dutch natural gas futures

to record highs last year.

The chart shows

the record peak in U.K. natural gas prices in March 2022 and the

steady decline over the past year.

The chart of

natural gas futures in the Netherlands shows the same bearish pattern

since the March 2022 all-time high.

While Russia has

used natural gas exports as an economic weapon against Western

European countries supporting Ukraine, an unseasonably warm winter

prevented shortages and sent prices lower. As LNG flows from the U.S.

to other worldwide consumers, U.S. natural gas inventories have risen,

and prices have declined over the past months.

The technical levels to watch in NYMEX natural gas

U.S. Henry Hub

NYMEX natural gas futures tend to peak during the late fall and early

winter months, while the energy commodity often falls to bottoms

during the spring. In June 2020, nearby futures fell to the $1.44 per

MMBtu level, the lowest price in twenty-five years since 1995. The

recent $1.967 low stands as short-term technical support, with the

June 2020 $1.44 low as the critical downside target during the current

bearish trend.

The long-term

chart shows

the all-time low in U.S. natural gas futures since 1990 was at the

$1.04 per MMBtu level in early 1992. However, crude oil’s example in

2020 is a warning that the downside is not limited to the $1.04 or

even zero level.

On the upside,

technical resistance is just below the $3.40 per MMBtu level, the

October and November 2020 highs. As the war in Ukraine continues, the

potential for sudden rallies remains a clear and present danger for

the energy commodity. The price action in nearby U.K. and Dutch

natural gas futures could guide U.S. prices, as rallies will cause a

sudden increase in U.S. LNG export demand.

One thing to

remember is that U.S. natural gas futures only reflect the delivery

price at the Henry Hub pipeline. Depending on local supply and demand

factors, regional prices can be much higher or lower. In Las Vegas, my

monthly gas bill remains five times the level as in previous years,

even though the NYMEX futures price dropped around 80%. I hope the low

futures prices filter through and lower my bills, but there is no

guarantee that will occur.

More Energy

News from

Barchart

On the date of publication, Andrew

Hecht did not have (either directly or indirectly) positions in

any of the securities mentioned in this article. All information and

data in this article is solely for informational purposes. For more

information please view the Barchart Disclosure Policy here.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|