|

August 4, 2022

Hydrogen Stocks

Reached a Critical Point and Are Primed to Soar

Over the next several years, improving

economics will drive the robust, widespread adoption of green hydrogen

August 3, 2022

By

Luke Lango,

InvestorPlace Senior Investment Analyst

- Walmart, the largest retailer,

recently announced a landmark deal with Plug Power, the largest

hydrogen producer, to supply enough green hydrogen to essentially

power every Walmart forklift in the world.

- When it comes to green hydrogen, the

two biggest cost inputs are falling rapidly. But when it comes to

gray hydrogen, cost inputs are rising.

- It’s possible that green hydrogen

costs are at the critical inflection point of becoming

economically viable, and this could very well be the start to the

world’s biggest retailer powering its entire operations with green

hydrogen.

Source: Shutterstock

[Editor’s note: “Hydrogen Stocks

Reached a Critical Point and Are Primed to Soar” was previously

published in April 2022. It has since been updated to include the most

relevant information available.]

They say timing is everything. And right

now, the timing is perfect to look for

hydrogen stocks to buy.

By “right now,” I quite literally mean

right now.

We said that 2022 would be the year

hydrogen comes into its own as a viable clean energy technology. And

that’s mostly due to the plunging cost of its production alongside the

soaring costs of oil and natural gas. (It all comes down to

economics). As a result, the $11 TRILLION Hydrogen Economy will start

to emerge.

Indeed, Walmart (WMT),

the largest retailer, recently announced a landmark deal with

Plug Power (PLUG),

the largest hydrogen producer. The latter will supply enough green

hydrogen to essentially power every Walmart forklift in the world.

Sure, its just forklifts. But you have to

start somewhere. Mark my words. This is the beginning of Walmart’s

entire operations — stores, trucks, forklifts, and more — shifting to

hydrogen power.

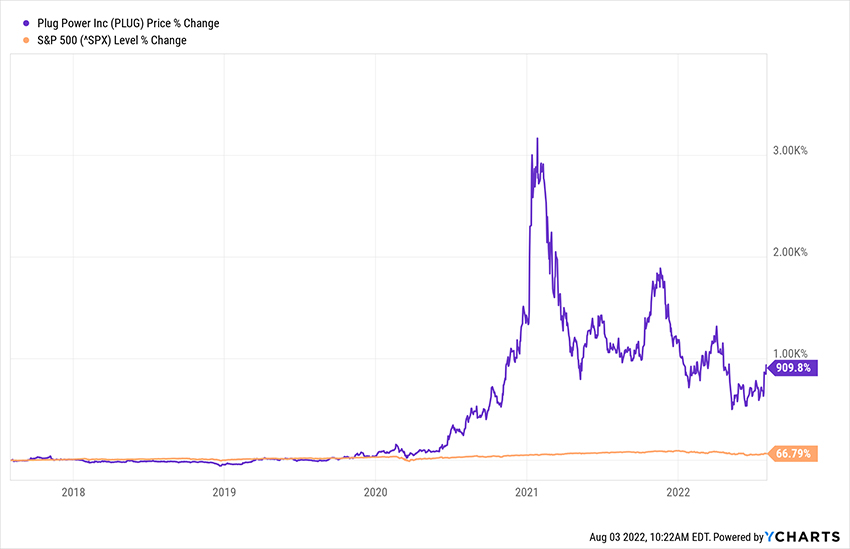

See why we’re so bullish? The deal

lit a fire underneath already-red-hot hydrogen stocks. Indeed,

Plug Power stock popped, adding to its already absurd 900%-plus gain

over the past five years.

But in truth, we think this party for

Plug Power — and all hydrogen stocks — is just getting started.

It’s time to buy. The

next wave of the energy revolution has arrived. And just

like the last wave — EVs and solar power — this will mint

millionaires, too.

The only question is: Will you be one

of them?

Walmart Kick-Started Hydrogen

Stocks’ Takeoff

We didn’t know it was going to happen.

But on the same day we said the Hydrogen Revolution was ready to kick

into hypergrowth mode, the world’s largest-ever green hydrogen

production deal was struck.

Specifically, leading H2 company Plug

Power announced its agreement to supply 20 tons of green hydrogen a

day to Walmart.

Context is required to understand the

magnitude of this deal because it’s much more important that it may

seem at first glance.

Hydrogen is the lightest element in the

universe. Therefore, hydrogen fuel cells are the most energy-dense

power source in the world. To that end, hydrogen fuel cells make the

most sense in long-range, heavy-use situations. There, you need an

energy source that packs a powerful punch and doesn’t need much

downtime. And one such application is forklifts.

So, over the past several years, Plug

Power has been hyper-focused on making hydrogen fuel cells for use in

forklifts. Walmart has long been interested in this idea. In fact,

since 2012, Walmart has bought thousands of hydrogen forklifts from

Plug Power.

Recently, Plug Power has expanded its

operational focus from being a hydrogen forklift company to being an

all-in-one hydrogen powerhouse. That has included the creation of

green hydrogen production plants.

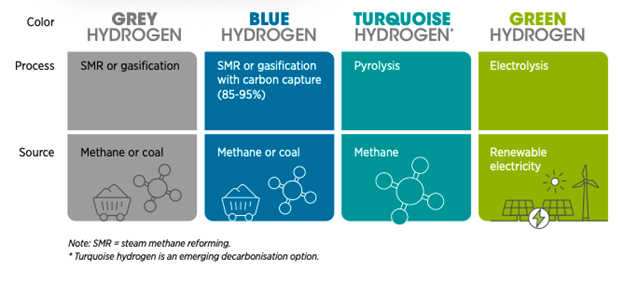

Quick recap: Green hydrogen is H2 that’s

produced from renewable energies. Funnily enough, despite hydrogen

being the most abundant element in the universe, it doesn’t exist in

its pure form naturally. Therefore, to produce it, we need to obtain

it from other energy sources. Those sources can be fossil fuels (which

produce “gray” or “blue hydrogen”) or renewables like solar (which

produce “green hydrogen”).

Hydrogen of Today

Most of the hydrogen energy in use today

is gray hydrogen. And that’s simply because the cost of producing

green hydrogen has been prohibitively expensive. Ecologically, that’s

problematic because gray hydrogen isn’t really a departure from fossil

fuels. It’s just wrapped in a different package.

Most energy analysts have long predicted

that the critical driver of the H2 Revolution hinges upon green

hydrogen becoming cost-effective.

We appear to be at that crucial

inflection point today.

Just look at the Walmart deal. The

world’s largest retailer wouldn’t be striking a deal for 20 tons of

green hydrogen per day — enough to power about 25,000 forklifts — if

it didn’t think Plug Power could deliver at cost-competitive levels.

And if that’s the case, then this is just

a sample of what’s to come. Walmart will test green hydrogen as a

forklift fuel source. Then, it will start using green hydrogen in its

delivery trucks and vans. End game, the company will use it to power

stores.

It’s possible that green hydrogen costs

are at the critical inflection point of becoming economically viable.

And this could very well be the start to the world’s biggest retailer

powering its entire operations with green hydrogen.

This may mark the beginning of a

new energy revolution.

The Start of an Energy

Revolution

Science seems to strongly back the claim

that green hydrogen costs are at a tipping point. And it bolsters the

belief over the next several years, improving economics will

drive robust, widespread adoption of green hydrogen.

In other words, Walmart may be the first

in a series of mega-corporations that start buying green hydrogen for

fuel.

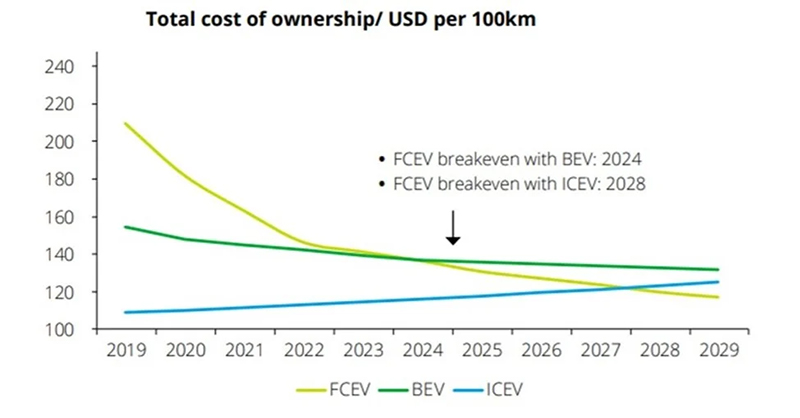

Oil and gas prices are the on rise. But

green hydrogen costs are falling. That’s because solar and wind

production costs are falling due to economies of scale. It’s also

because electrolyzer costs are falling. And electrolysis is a key

component of green H2 production.

So, when it comes to green hydrogen, the

two biggest cost inputs are falling rapidly. But when it comes to gray

hydrogen, cost inputs are rising.

The result? A flip-flopping of the

cheapest hydrogen production method.

In April 2022, due to the spike in gas

prices, Europe, the Middle East, Africa and China saw green hydrogen

costs drop below that of gray hydrogen. According to Bloomberg New

Energy Finance, green hydrogen production is about 15% cheaper

throughout Europe and 40% cheaper in China.

This marks a critical

moment in time.

Green hydrogen wasn’t supposed to be

cheaper than gray until 2030. But it’s already made it there. Original

projections called for H2 costs to break even with fossil fuels in

2028. Though it seems that moment may come much sooner.

In other words, green hydrogen may soon

be, if it’s not already, the cheapest energy source in the

world.

No wonder Walmart signed the biggest green hydrogen

production deal ever.

The Final Word on Hydrogen

Stocks

Some things in life are coincidences.

This is not. This the world’s largest retailer’s strategic deal to

secure green hydrogen production before a “gold rush” occurs very

soon.

And this gold rush will send hydrogen

stocks —

and all alternative energy stocks — significantly higher.

They say timing is everything. Well,

today, the timing couldn’t be more perfect for hydrogen

stocks — or any alternative energy stocks, really.

With fossil fuel prices soaring and

renewable energy expenses dropping, cost-parity dates for clean

energies have been accelerated by years. So, too, has the entire New

Energy Revolution.

There are many ways to play it — hydrogen

stocks. solar or wind stocks, energy storage stocks;

even battery stocks.

All represent great long-term investments

that will generate huge returns over the next three, five, and 10-plus

years. Find out more about those excellent investment opportunities.

I’ll give the final word to Plug Power’s

own CEO, Andy Marsh:

“I’ve been here the worst of times

and the best of times. This is one of the best of times.”

On the date

of publication, Luke Lango did not have (either directly or

indirectly) any positions in the securities mentioned in this article.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|