|

May 16, 2023

By Akshat Rathi

Big money rushes in before the results

You can read and

share

a free version of this story

on Bloomberg.com. Subscribe

to Bloomberg for unlimited access to climate and energy news,

and to receive the Bloomberg Green magazine.

The prospect of

trapping carbon dioxide and storing it away so it can’t warm the

planet has always been tantalizing. Now governments and companies

are throwing their weight behind the technology as a way of solving

the climate problem like never before.

The oil and gas

industry has long argued that real emissions reductions can be

delivered by removing CO2 from smokestacks and burying it deep

underground — an approach known as carbon capture and storage (CCS).

But after decades of failing to reach the scale needed to make a real

difference, the people responsible for approving generous subsidies

and directing billions in investment want proof that this time it will

really work.

As part of rules

proposed last week to lower carbon pollution from US power plants,

President Joe Biden will require some plants to build CCS or shut

down. The regulation comes after incentives in the form of tax credits

of up to $85 a ton of captured CO2 were allocated in Biden’s landmark

climate bill, alongside infrastructure legislation with $8.5

billion to boost CCS technology. Those steps will see the US

host nearly half of the world’s CCS capacity by 2030, according to

BloombergNEF.

Earlier this

month, COP28 President Sultan Al Jaber signaled that CCS will also

play a major role in the annual United Nations climate summit to

be hosted by the United Arab Emirates.

Private

companies are also jumping in. JPMorgan Chase & Co., Alphabet Inc.,

Meta Platforms Inc., McKinsey & Co. and others have contributed to a

$1 billion fund that will buy

carbon-removal credits to support technologies that draw down CO2

that already exists in the atmosphere. Microsoft this week announced a

deal to buy

similar credits from the Danish energy giant Orsted A/S.

These technologies to remove existing carbon pollution from the air

will be needed at scale in the latter half of the century to keep

global warming below 1.5C, but they are much more expensive than

trapping emissions from smokestacks.

“It’s an

exciting year for the industry,” said Jessie Stolark, executive

director of Carbon Capture Coalition, a US lobby group. “But we’re not

suggesting it’s a silver bullet. It’s important to deploy

carbon-management technologies alongside a full portfolio of

emissions-reduction strategies.”

CCS is not

just one thing. It’s an umbrella term for a set of technologies that

separate CO2 — the main greenhouse gas — from a mixture of gases and

then find a way to ensure it does not enter the atmosphere. Depending

on the mixture of gases involved (if the facility burns coal or making

cement, for example) and depending on where the gas is stored (if it’s

buried underground or turned into commercial products), the cost of

building CCS plants can vary a lot.

The first

large-scale carbon capture plant was built in the 1970s. Its job was

to separate CO2 from natural gas, then inject the greenhouse gas

underground to extract more oil from a depleting reservoir. That’s

what the vast majority of the world’s captured CO2 is currently used

for, according to the Global CCS Institute. Using CCS specifically to

help mitigate global warming only started in the 1990s, and still

remains on a smaller scale.

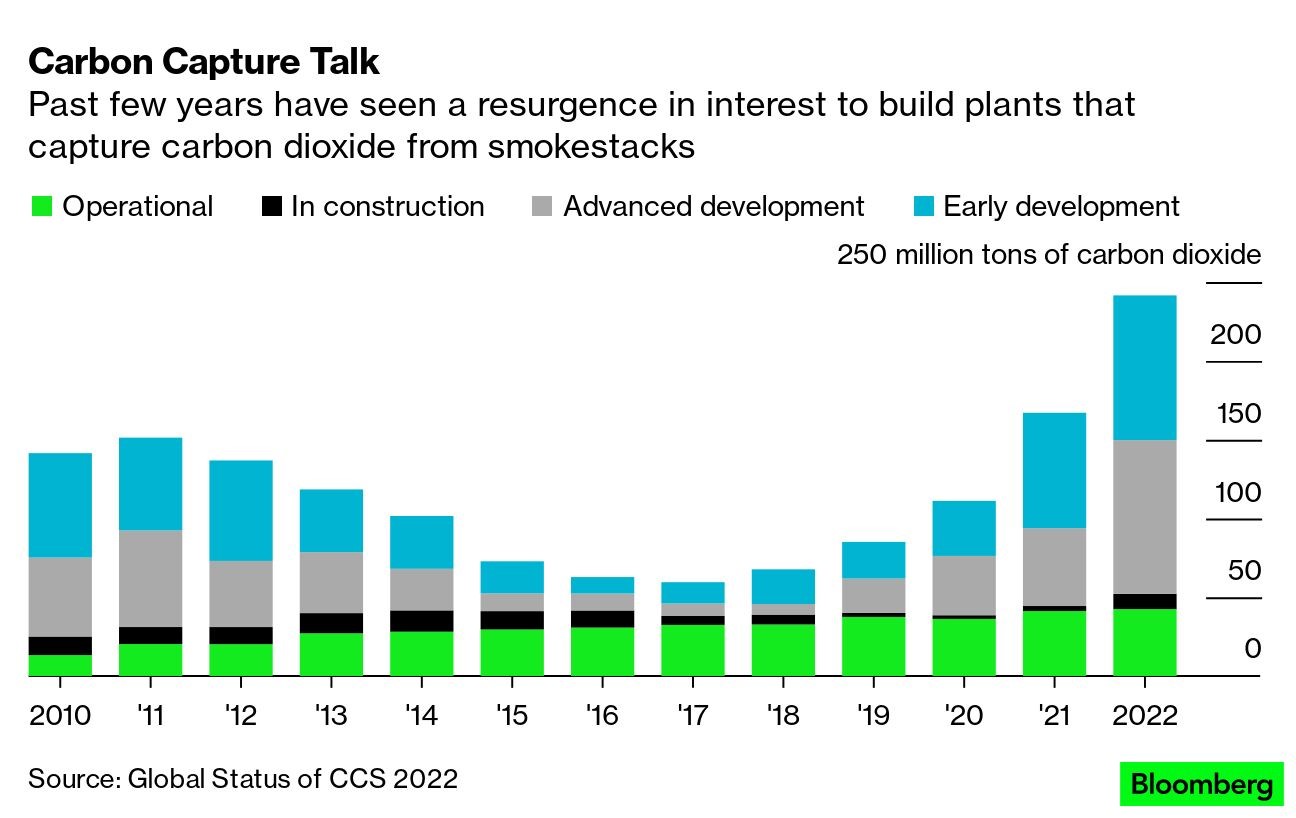

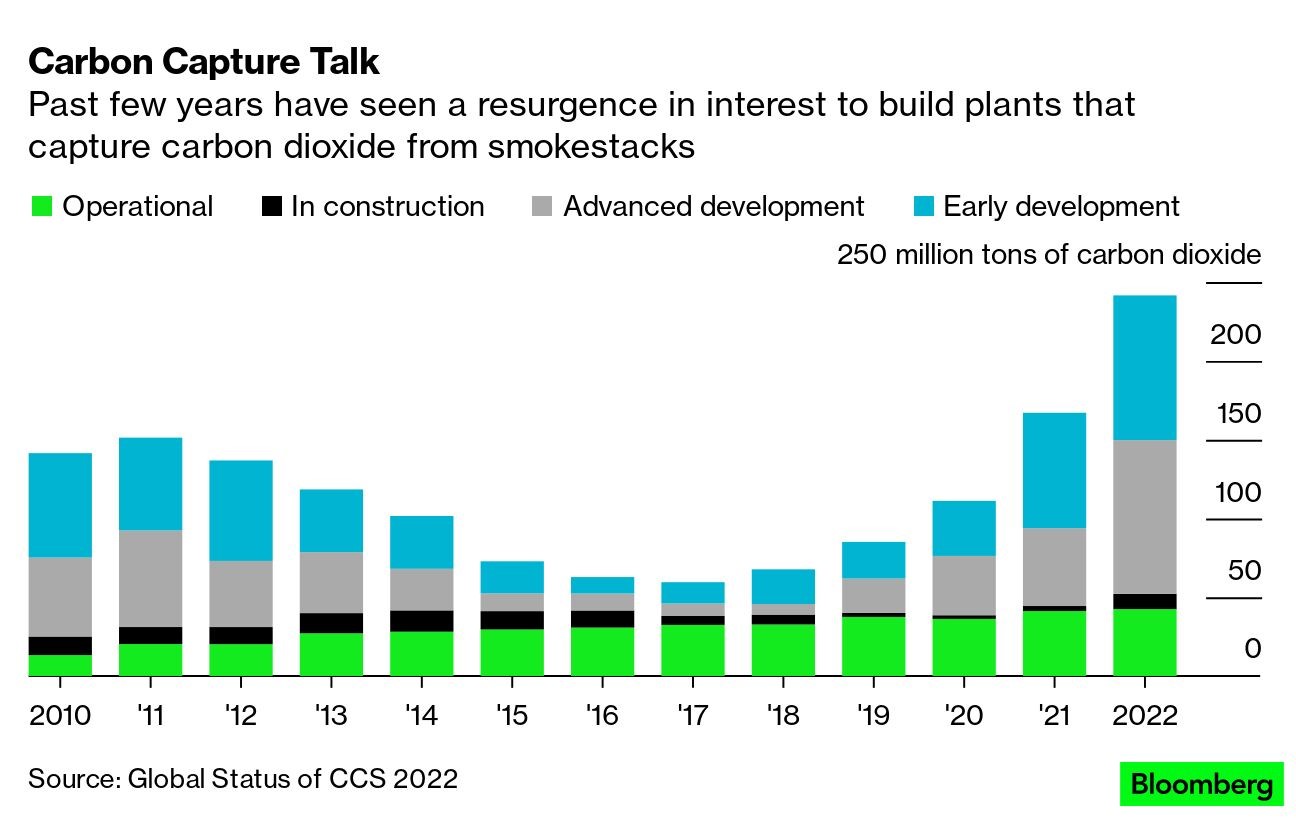

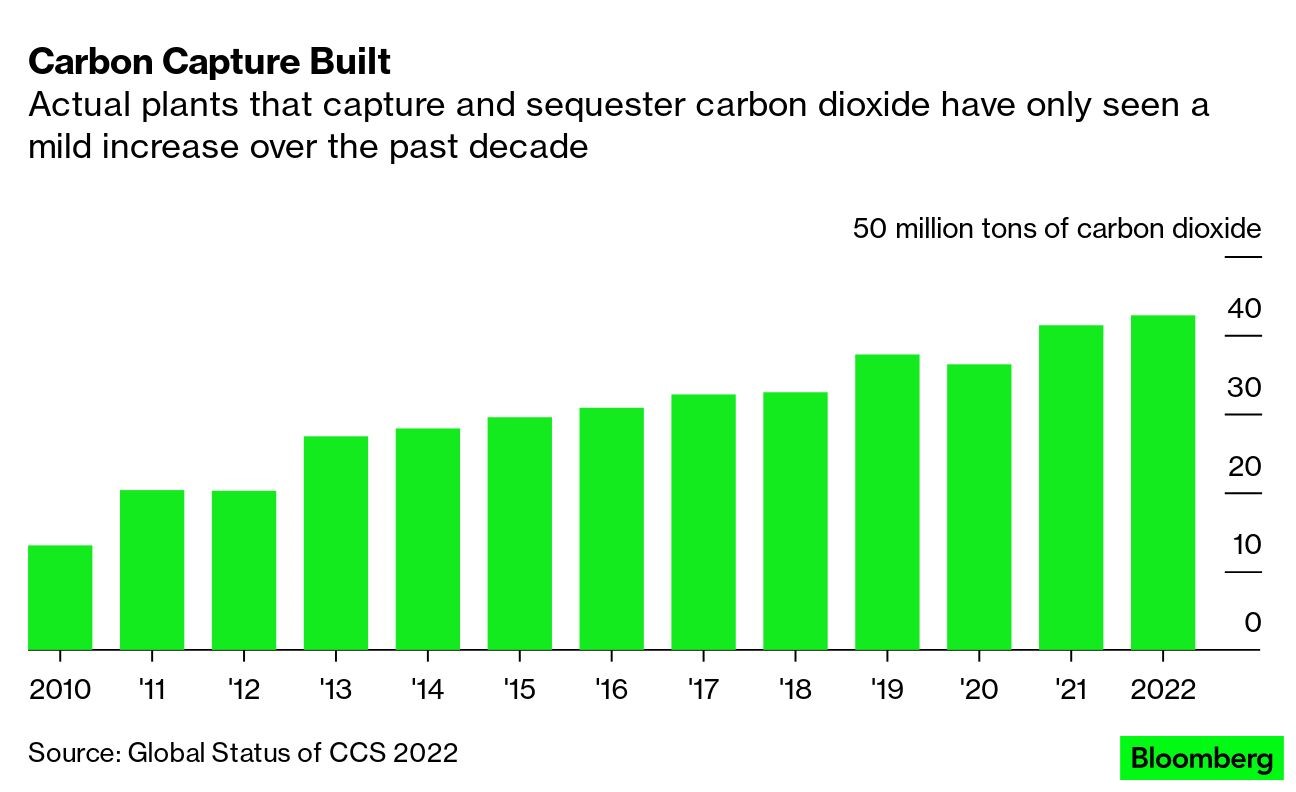

Despite its

50-year history, all the CCS plants deployed globally capture only

about 40 million tons of CO2 each year. That’s less than 0.1% of

global greenhouse-gas emissions. If every plant in the pipeline

collated by the Global CCS Institute gets built, that would grow to

about 0.5%. But will the boom happen? The past decade is littered with

CCS plants that were announced to great fanfare but were never

constructed, along with some

multibillion-dollar failures after building began.

The majority of

CCS plants in the world are operated by oil and gas companies. That’s

because the industry has developed the expertise needed to safely

handle large volumes of gas. However, unless CCS was tied directly

to revenue in the form of oil or carbon taxes, few plants found viable

business models that

justified significant investment.

Listen to Occidental Petroleum’s Vicki Hollub on the Zero podcast talk

about how carbon capture is

crucial for the US oil company’s future.

On the other

hand, there is a growing demand for carbon-removal credits that help

global corporations

credibly meet net-zero goals. That has, in turn, led to a large

number of startups developing these technologies and shows that CCS

can thrive with alternate business models outside the confines of

large fossil-fuel corporations.

The failure of

CCS to live up to its grand promises is why the support this time also

comes with a stronger note of skepticism. “We can’t sit here and just

pretend we’re going to automatically have something we don’t have

today,” US climate envoy John Kerry

told the AP. “Because we might not. It might not work.”

Al Jaber, who

also heads the UAE’s oil giant Abu Dhabi National Oil Co., has said

that COP28 should focus on getting the world on track to halving

emissions by 2030. But serious COP watchers, including former United

Nations climate chief Christiana Figueres, aren’t sure whether Al

Jaber’s push for CCS will get us there. “We do not have carbon capture

commercially available and viable over the next five to seven years,”

she said on the

podcast Outrage and Optimism. “So just from the timing

issue... [it] cannot be where you put your eggs into that basket.”

In a world on

track to reach net-zero emissions by mid-century, global CCS capacity

needs to reach 1.3 billion tons of captured carbon annually by 2030,

according to the

International Energy Agency. That’s roughly 30 times the capacity

today. The goal is ambitious and the industry has to show progress,

according to IEA chief Fatih Birol

wrote in a LinkedIn post last week. “This year is a unique

opportunity for the oil and gas industry to show it’s serious about

tackling climate change,” he said.

Akshat

Rathi writes the Zero newsletter, which examines the world’s race to

cut emissions. You can email

him with feedback. His book Climate

Capitalism will be published later this year.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|